Today we are gambling in class!

Before StartingWhat are the chances of winning a coin flip?

Everyone starts with three coins, what do you think will happen as the contest goes on?

Rules:

- Everyone will get 3 pennies.

- You must find someone to wager against and continue wagering.

- Take turns flipping and wagering (one person picks the wager and one calls heads/tails).

- When I pause the action, be sure to count your coins and be counted!

Charting the distribution of coins

round 1 2 3 4 5

#coins

BEGIN WAGERING!

The exercise was a metaphor for social class.

The exercise resembles real life in a number of ways:

Americans Believe that the Economic System is Fair and Equal

1. Like life in the U.S., the exercise had the appearance of being fair and equal - everyone had a 50% chance of winning. The U.S. is an open system - not a caste system or closed system like a monarchy or apartheid. Our system gives the impression that everyone has an equal chance and that the system is fair. The coin flip metaphor seems like everyone has a 50-50 chance to succeed. This is true for U.S. society too. From Jen Hochschild's book, Facing Up to the American Dream, Americans believe in the "American dream;" success is attainable for anyone. However, just like real life, the coin game takes a little luck. If you are lucky enough to be born in wealth, it is an advantage just like being lucky to win early in the game.

Social Class "Rules" Create a Similar Distribution of Wealth

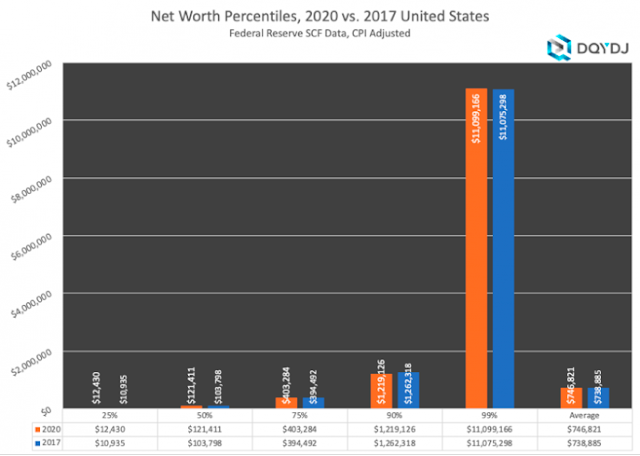

2. However, our system, although open, is a social class which is made up of unwritten rules. The way the rules are written, the money will flow to the top with just a few having most coins and most people having very little. (See the graph at the right from here)

2. However, our system, although open, is a social class which is made up of unwritten rules. The way the rules are written, the money will flow to the top with just a few having most coins and most people having very little. (See the graph at the right from here)More Money, More Problems? Not for Social class

3. The more money you have the more opportunities you have. Donald Trump's corporation filed for bankruptcy at least 4 times, but he had enough wealth and power and prestige to recover from the bankruptcies. (note: I have been using this example long before Trump's foray into politics)

Defining Middle Class

4. The difficulty of middle class. Most Americans claim to be in the middle class. People making $30K per year to people making $200K per year claim to be in the middle class. However, defining the middle is difficult because there is so much money skewed to the top and there are so many people at the bottom. Even though the game has the appearance of being an equal 50-50 chance, the rules favor a channeling of wealth to the top. Everytime we play this, the outcome is similar: most money at the top and most people at the bottom with very little money. This is true in real life as well as the metaphor. Here is a graph showing wealth distribution in the U.S.:

Compare this graph to a graph of the coin distribution at the end of the game.

Some of the specific similarities include:

How difficult it is to define the middle class.

The huge disparity between those at the top and those at the bottom.

The large number of Americans who have no wealth/no coins.

In Summary

To summarize, most U.S. citizens do not like the idea of social class. They do not like to acknowledge the rules that create the distribution of wealth that we see in the exercise. But the reality is that our wealth and even our income in the U.S. resembles that of the coin flip metaphor; a few individuals at the top with enormous wealth and income and most people at the bottom making very little (comparatively).

And the "rules" of our society help to create that dynamic. By "rules" I mean the opportunities and obstacles that we face based on our social class.

Examining Data About Social Class

So why bother studying social class in the U.S.?

MindfulnessFrom the Economic Policy Institute,

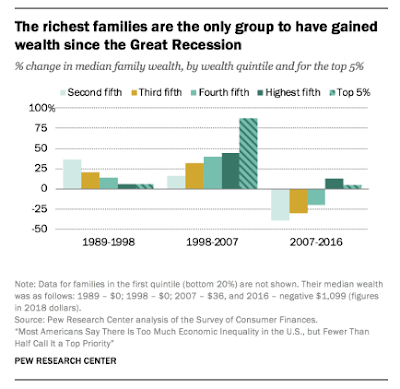

Most Americans believe that a rising tide should lift all boats—that as the economy expands, everybody should reap the rewards. And for two-and-a-half decades beginning in the late 1940s, this was how our economy worked. Over this period, the pay (wages and benefits) of typical workers rose in tandem with productivity (how much workers produce per hour). In other words, as the economy became more efficient and expanded, everyday Americans benefited correspondingly through better pay. But in the 1970s, this started to change.

Social class inequality in the U.S. is growing and has been for decades. This growth is profoundly shaping the United States even though few seem to recognize it. Economic inequality is influenced by many factors, including the economy, public policy and social changes. The last several decades, income inequality has been growing. The highest earning Americans have continued to earn more and more over the last 50 years, while the lower earners have earned closer to about the same.

All of these components both exemplify social class inequality and they exacerbate it. Please read about each element below. Remember to think about what an average American looks like and how your family compares. I want you to have a better understanding of where your family fits compared to the average American when the lesson is finished.

Wealth; The First Component of Social Class

Wealth is tricky to understand. It is everything that a household owns, such as the home, vacation home, cars, 401K, savings, stocks, jewelry, etc...But, you must subtract what the household owes. So, if my house is $200,000 but I owe $160,000 then my wealth is only $40,000 on the house.

Bottom 20%:______ 2nd 20%_______ 3rd 20%________ 4th 20%_______ 5th 20%_______Top

(least) (most)

Second, write how much you think each quintile should have?

Bottom 20%:______ 2nd 20%________ 3rd 20%________ 4th 20%_______ 5th 20%_______Top

After you have finished answering the questions above, watch this video:

What is the reality? How is the wealth actually divided?

1. How does your guess about wealth compare to how it is actually distributed? (Here is the Google form for this lesson - I recommend opening this in a new window and then answer each question after you read the info.)

This video from the ST. Louis Fed also explains the disparity in wealth in the US (2019).

The overall conclusion about wealth is that the disparity of wealth is greater than that of income (see the pie graph below). The top 1% of America owns 34% of everything. The top 10% owns 70%. And half of America owns 96% of everything. In other words, the bottom half, 50% of America, owns almost nothing. They have no money saved - for retirement or otherwise. Once you deduct their debts, they have almost no equity - from their homes, or possessions, or bank accounts.

The average wealth of Americans

From DQYDJ (Don't Quit Your Day Job)

... is a finance and investing website founded in 2009 that posts about investing and adds interactive features, tools, and calculators to their posts.

The DQYDJ 2020 analysis of wealth in America calculates the median net wealth for Americans at $121,000:

The median is up from this 2010 Huffington Post report which analyzed a Congressional Research Bulletin about wealth, "The median household net worth -- the level at which half the households have more and half have less -- was $77,300" For a much more detailed analysis of wealth, see this post from business insider.

Average American:

- 90% own 1 car, 50% own 2 cars (actual average is 1.8 cars per household),

- 50% have a 401K,

- 66% own 1 home, (only 6% own a second home like a condo or lake house).

- how much the total household net worth is

- cars

- 401K

- owning a house or second home

No comments:

Post a Comment